Budget 2025 Highlight

With the theme “Ekonomi MADANI Negara Makmur, Rakyat Sejahtera,” Budget 2025 Malaysia presented by Prime Minister Datuk Seri Anwar Ibrahim on October 18th, 2024, has drawn wide attention from Malaysians—especially on affordability, wages, and cost-of-living priorities.

In this guide, we summarise the most important Budget 2025 Malaysia announcements across housing, rakyat assistance, and national development—so you can quickly understand what may impact households and the property market in 2025.

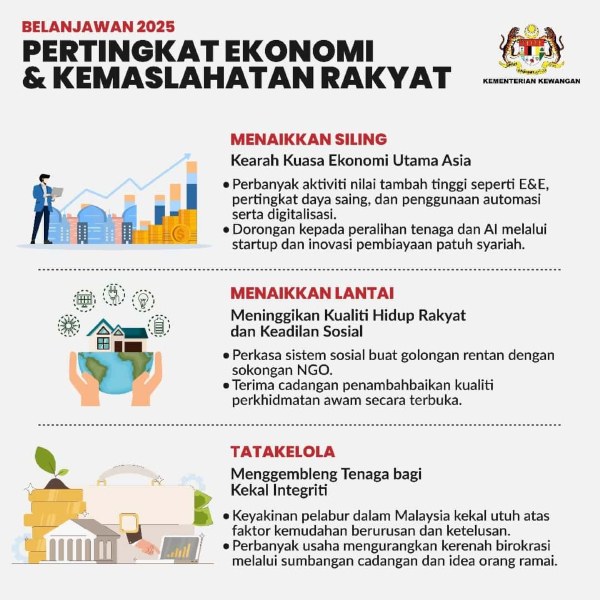

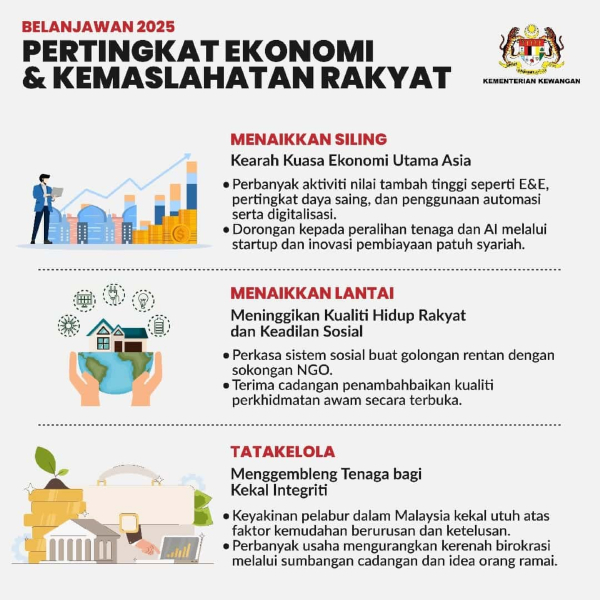

Budget 2025 Malaysia sets a total allocation of RM421 billion. The tabling highlights three broad pillars: Raise the Ceiling, Raise the Floor, and Good Governance & Public Sector.

For official reference, you may read the Ministry of Finance document here:

Budget 2025 Malaysia (MOF) – Speech Document (English PDF).

So, what does Budget 2025 Malaysia mean for the people—and what could it signal for the property and real estate landscape?

Budget 2025 Malaysia: Table of Contents

Real Estate Focuses

Several Budget 2025 Malaysia highlights directly touch housing supply, homeownership support, and financing affordability.

Affordable Housing

A total of RM900 million is allocated for 48 People’s Housing Program projects and 14 Friendly People’s Housing projects. This includes new projects in Port Dickson and Seberang Perai Tengah, with a number of projects targeted for completion by end-2025.

PPR

As part of Budget 2025 Malaysia, the government highlighted support for low-income households under the People’s Housing Programme (PPR), including allocations for upgrading facilities and community improvements.

Home Loan Agreement

One of the most discussed Budget 2025 Malaysia measures is personal income tax relief of up to RM7,000 for mortgage interest payments, subject to eligibility and qualifying conditions.

Those who finalise a home loan agreement from January 1, 2025 to December 31, 2027 may qualify for the tax relief (subject to the official terms). The highlights also mention tax relief related to purchasing residential properties valued up to RM500,000 (subject to conditions).

Housing Development

Budget 2025 Malaysia includes an allocation of RM200 million for the development of affordable housing on waqf land by UDA. Additional collaborations were also referenced for affordable housing, student accommodations, and commercial development initiatives.

Sejati MADANI

The government also plans to set aside RM1 billion to support the Sejati MADANI Community Prosperity Project, with the objective of strengthening community-level economic outcomes.

All States Development

For Sabah and Sarawak, the MADANI government aims to reduce development gaps through investments in roads, electricity, and clean water. The total public investment for development in 2025 is expected to reach RM120 billion.

Forest City

A new financial entity is referenced to fund construction and redevelopment of Forest City, with aims related to economic activity and job creation. The NETR project is also referenced with implementation initiatives such as hydro-floating solar and green hydrogen developments.

Bantuan Rakyat

Budget 2025 Malaysia includes expanded Bantuan Rakyat initiatives and allocations aimed at household resilience and targeted assistance.

Ikhtiar Sejati Madani Initiative

A total of RM1 billion is designated for the Ikhtiar Sejati Madani initiative, including allocations for rural economy, Kampung Angkat Madani, university participation, and PPR community empowerment.

STR

The budget for STR in 2025 is referenced to rise to RM13 billion, supporting a large number of recipients.

B40

Monthly welfare aid for the poorest elderly citizens is referenced as increased to RM600, with child assistance rates also outlined in the highlights.

Youth

For young individuals aiming for first-home ownership, the highlights mention a RM5 billion Step Up Financing Scheme (1-Skim Step Up Financing) as an affordability pathway.

Basic Salary Rate

The minimum wage is referenced to increase to RM1,700, with staged enforcement for smaller employers.

Public Transport

Public transport improvements and continuation measures are referenced, including fleet upgrades and ongoing monthly pass benefits in selected regions.

Other Highlights

Education

Budget 2025 Malaysia includes education allocations and policy directions, including funding support and incentives related to targeted skill development areas.

MyDigital ID

Digitalisation measures are referenced, including MyDigital ID as an integrated platform supporting streamlined access to government services.

Health

Health-related allocations and tax deductions are referenced, alongside funding priorities for services and infrastructure upgrades.

New Taxes

The highlights reference new or expanded tax measures across selected categories, including dividend tax thresholds, carbon tax direction, and sugar-sweetened beverage levy.

Entrepreneur

For businesses, Budget 2025 Malaysia highlights include funding and digital transition support, plus targeted allocations for SMEs and women entrepreneurs.

Penang Property Angle: What to Watch in 2025

While Budget 2025 Malaysia is national, Penang’s property market often reacts strongly to initiatives that affect affordability, infrastructure delivery, and business confidence. If you are tracking Penang real estate—especially near key growth corridors—watch how financing accessibility, wage changes, and development allocations influence:

- Homebuyer sentiment and transaction volume

- Rental demand in job-centric areas

- Commercial activity that supports industrial and logistics expansion

Related Resources

Internal (YC Tang Property)

- YC Tang Property – Industrial & Commercial Properties in Penang

- Browse Properties for Rent

- Browse Properties for Sale

External (Authority / Reference)

Conclusion

Overall, Budget 2025 Malaysia aims to balance cost-of-living pressures with growth and development priorities. With housing allocations, loan-related relief references, and broad rakyat support measures, the budget may influence both homebuyer confidence and market activity.

If you are planning your next property move—buying, upgrading, or investing—use the Budget 2025 Malaysia highlights as a planning signal, but always verify eligibility and implementation details through official sources and professional advisers before making commitments.